Regulatory Compliance Checklist for Aadhaar and Data Masking Across Industries

In today’s digital economy, data privacy and compliance are non-negotiable. With Aadhaar serving as the primary identity document for millions of Indians, organizations across industries from banking and fintech to telecom and healthcare are under immense pressure to manage sensitive Aadhaar data responsibly. Misuse or mishandling of Aadhaar information can lead not only to severe penalties under UIDAI and RBI regulations but also to reputational damage and loss of customer trust.

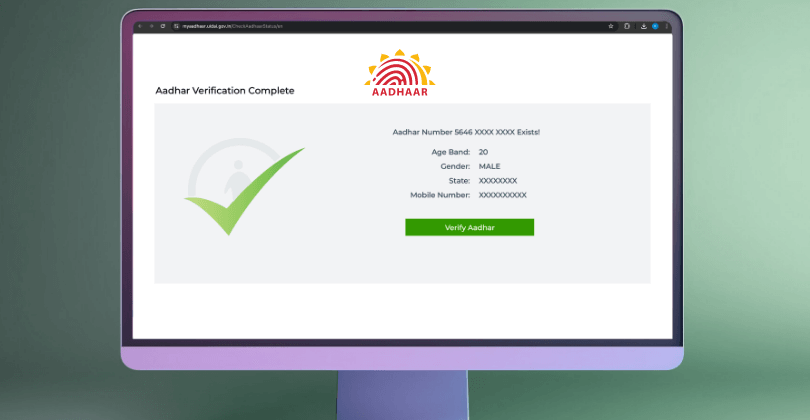

One of the most effective ways to ensure security while maintaining compliance is through data masking solutions. By obscuring or anonymizing sensitive Aadhaar data, businesses can protect customer identities, reduce risks of breaches, and seamlessly meet regulatory standards.

This blog outlines the critical compliance requirements around Aadhaar, explains the role of data masking across industries, and provides a practical checklist to help organizations strengthen their data protection frameworks.

Understanding Data Masking and Its Relevance Across Industries

Data masking is a technique used to protect sensitive information by replacing or hiding original values with anonymized or partial versions. Unlike encryption, which requires decryption keys, masking ensures data cannot be reversed, making it particularly effective for compliance and privacy.

Key Applications Across Industries

- Banking & Financial Services (BFSI): Masking Aadhaar during KYC and loan approvals prevents identity misuse while ensuring regulatory compliance.

- Telecom:During SIM activation, masked Aadhaar details allow customer onboarding without exposing full identity numbers.

- Healthcare: Patient Aadhaar details can be masked during record-sharing to protect confidentiality while still enabling accurate verification.

- Fintech & Digital Platforms: Masking supports secure e-KYC workflows, preventing fraud and ensuring smooth digital onboarding.

By adopting masking, industries not only safeguard their customers but also create a trust-first digital ecosystem.

Regulatory Compliance Requirements for Aadhaar Data Usage

The Unique Identification Authority of India (UIDAI) and other regulatory bodies have defined strict guidelines around Aadhaar usage. Organizations handling Aadhaar must align with the following

- Aadhaar Act 2016:Mandates protection of Aadhaar data and outlines penalties for unauthorized sharing or misuse

- UIDAI Guidelines: Require that Aadhaar numbers are masked before storage or display, with only the last 4 digits visible.

- RBI Regulations: Financial institutions must ensure compliance in e-KYC processes, safeguarding sensitive Aadhaar information.

- Data Protection Bill (India) Proposes stringent requirements for data privacy, imposing heavy penalties for breaches and violations.

- Sector-Specific Circulars:Telecom and BFSI industries receive regular compliance notifications requiring masking as part of KYC processes

Regulatory Compliance Checklist for Aadhaar and Data Masking

To help businesses stay compliant, here’s a comprehensive checklist:

Aadhaar Masking Practices

- Display only the last 4 digits of Aadhaar numbers as mandated by UIDAI.

- Implement OCR and AI-driven masking tools to automate Aadhaar detection.

- Ensure dynamic masking for real time KYC and e-KYC workflows

Data Storage & Access Controls

- Store masked Aadhaar data securely in encrypted databases.

- Limit access to unmasked Aadhaar details strictly to authorized personnel.

- Maintain audit logs for every data access and modification.

Regulatory Compliance Alignment

- Regularly review UIDAI, RBI, and government circulars for updates.

- Integrate compliance first design into customer onboarding solutions.

- Conduct periodic compliance audits to identify gaps.

Operational Best Practices

- Train employees on Aadhaar data privacy and masking protocols.

- Adopt enterprise-grade masking APIs and SDKs for seamless integration.

- Establish incident response frameworks for handling data breaches.

Customer-Centric Privacy

- Clearly communicate to customers how Aadhaar data is masked and protected.

- Use masked Aadhaar for all external communications, receipts, and onboarding documents.

- Build transparency to enhance digital trust.

Real-World Examples of Compliance Success

- Banking:A leading private bank implemented AI powered Aadhaar masking for its e-KYC process. This reduced data exposure risks and ensured 100% compliance with UIDAI mandates.

- Telecom A major telecom provider integrated masking APIs into its SIM activation platform, preventing unauthorized staff from accessing full Aadhaar numbers

- Healthcare:Hospitals adopted Aadhaar masking in patient records, enabling smooth insurance claims while protecting sensitive health and identity details.

- Fintech:Digital lending platforms used real time dynamic masking during customer onboarding, reducing fraud cases by over 40%.

These examples demonstrate that effective Aadhaar and data masking practices are not only regulatory requirements but also operational advantages.

Conclusion

As industries increasingly rely on Aadhaar for identity verification, the risks of mishandling data have never been higher. From legal repercussions under the Aadhaar Act 2016 to emerging requirements in India’s Data Protection Bill, businesses cannot afford to overlook compliance.

Aadhaar masking and data masking solutions provide a future proof way to meet regulations, reduce risks, and build trust with customers. By following the compliance checklist outlined above, organizations can confidently navigate the complex landscape of data protection.

Now is the time for businesses to audit their compliance frameworks, adopt enterprise grade masking technologies, and prioritize customer data privacy. In doing so, they not only stay compliant but also strengthen their position as trusted, responsible industry leaders.