Importance of Aadhaar Masking For Fintech Business

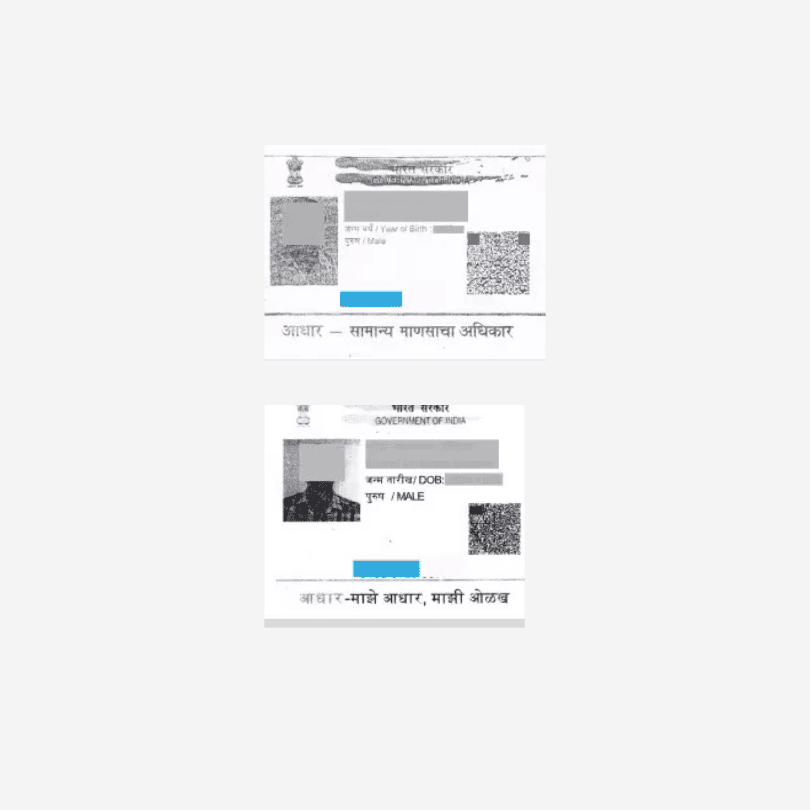

You can hide your Aadhaar variety in your downloaded e-Aadhaar pattern through the Mask Aadhaar option. Masked Aadhaar numbers are created by substituting the first eight digits of the Aadhaar number, leaving only the last four digits exposed.

The Aadhaar Masking solution can be used where you have to provide Aadhaar only as identity proof. You can Grand a masked Aadhaar to verify your photo along with the last 4 digits of the unique ID. This masked form of your Aadhaar, your photo, QR code, demographic information, and other details will still be present.

Aadhaar Masking is a Government Regulation.

Businesses must protect the privacy of Aadhaar holders. Every business assembling Aadhaar cards from customers can be got to abide by masking the primary eight digits of Aadhaar before storing them in their systems. Aadhaar and its rules are ruled by UIDAI and followed by varied regulators like RBI, IRDAI, TRAI, and SEBI. The regulations pretty much mandate that every business collecting Aadhaar cards mask the first eight digits of the Aadhaar number once the KYC is completed.

Aadhaar Masking Image Formats.

We support a variety of image formats that are commonly accepted by businesses. We support PDF, JPG, PNG, TIFF, BMP, and Base 64 formats. Besides, we also support single and multiple-sided aadhaar images, straight and rotated images, color and greyscale aadhaar images, and front and back of aadhaar on the same page as well for a successful aadhaar masking.

What Does it Mean for Fintech Business?

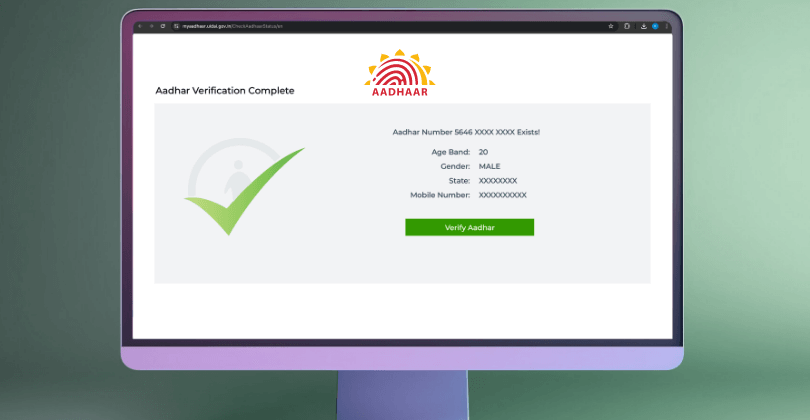

Aadhaar continues to be the most commonly submitted document in the KYC process. Financial establishments currently ought to mask Aadhaar numbers on all the client pictures that they store. The UIDAI indicated that banks may accept a masked Aadhaar card for customer verification while opening bank accounts provided it has been offered voluntarily and the first eight digits of the Aadhaar number are masked while storing a physical copy of the Aadhaar card.

Why Aadhaar Masking is Mandatory for Fintech Industry.

Following the footsteps of RBI and SEBI allowing regulated entities to onboard and verify customers using a masked aadhaar. IRDA has taken steps to let Insurance Companies do the corresponding things. Here’s how you can use our ready-to-use, zero integration, secure and enterprise-grade aadhaar masking to onboard fintech industries.

The CIS declared that the info leak was primarily because of the absence of correct masking measures. This had publicly disclosed sensitive information about Aadhaar holders, which included their addresses, photographs, and financial data. A valid Aadhaar number is a key to open multiple levels of locks to sensitive information that is very critical to an individual. Additionally, an associate degree exposé in 2018 showed that the whole Aadhaar info may well be purchased for as very little as Rs500 in ten minutes. Post continual apprehensions being raised over alleged Aadhaar card knowledge leaks and other people inculcating a way of concern to use Aadhaar as a PoI, the UIDAI introduced the cloaked Aadhaar.