How ID card Masking Solutions Enhance KYC, e-KYC, and Customer Onboarding Processes?

KYC (Know Your Customer) and e-KYC (electronic Know Your Customer) are essential processes that enable businesses to verify the identity of their customers while ensuring compliance with regulatory standards. These procedures are particularly critical in financial services, insurance, telecom, and other regulated sectors where sensitive personal information is collected and verified.

Customer onboarding, which encompasses these verification processes, plays a pivotal role in establishing trust, preventing fraud, and ensuring a seamless experience. As digital adoption accelerates, protecting customer data during onboarding has become a top priority. Masking solutions have emerged as a powerful tool in safeguarding sensitive information, enhancing verification workflows, and helping businesses maintain compliance while building customer confidence.

Understanding Masking Solutions

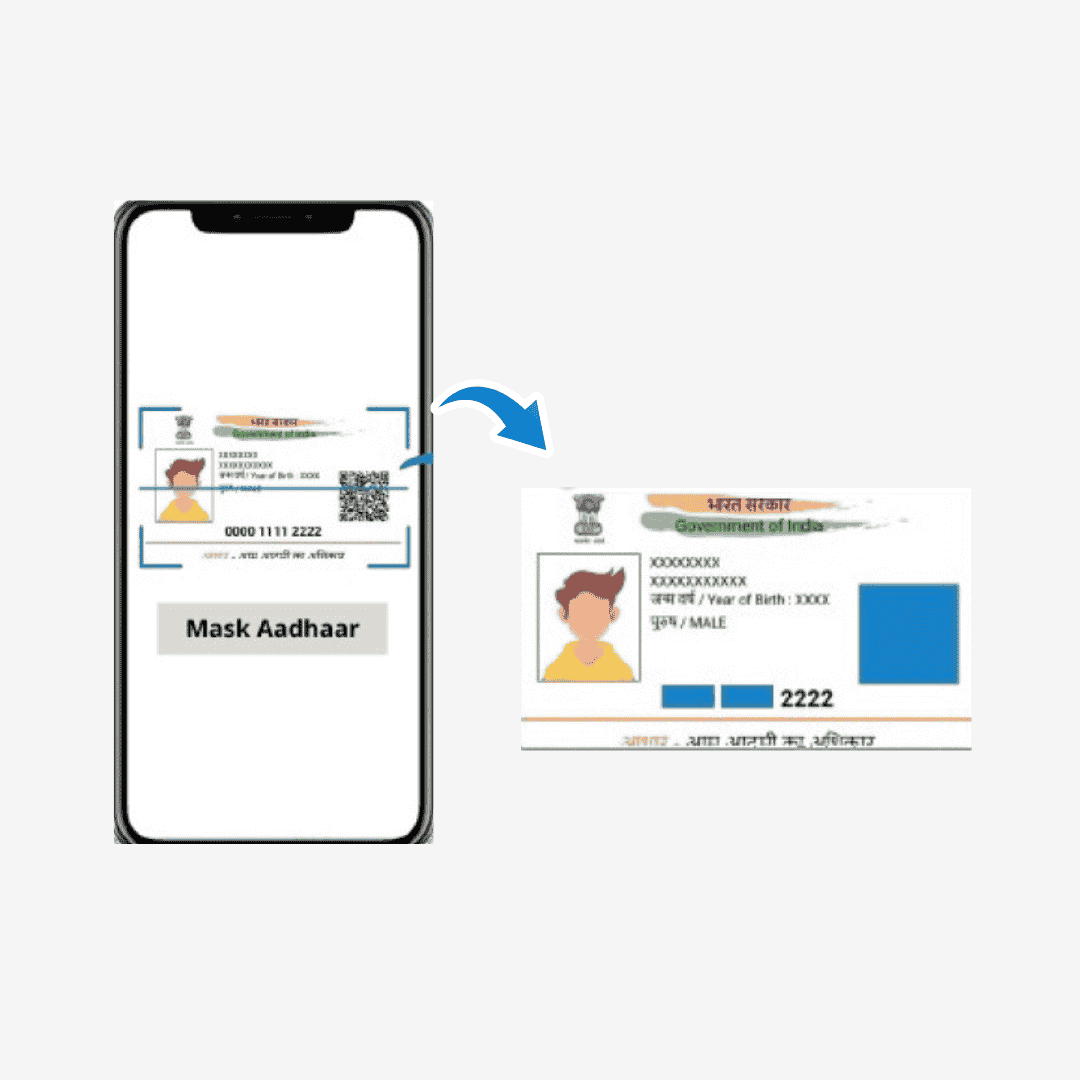

Masking solutions are data protection techniques that obscure or replace sensitive information to prevent unauthorized access while preserving the usability of data for verification and operational processes.

Types of Masking Techniques

- Static Masking:In this method, sensitive data is replaced or hidden in a permanent manner within datasets. It is often used in offline processes like batch processing or reporting.

- Dynamic Masking: Here, data is masked in real-time, allowing users to view or process data without ever exposing the original information. This is especially useful in live verification scenarios such as e-KYC.

Importance of Masking

Masking solutions are essential for protecting personally identifiable information (PII), financial details, and other confidential data. By limiting exposure, masking reduces the risk of data theft, misuse, or accidental leaks, ensuring that customer information remains secure throughout verification and onboarding workflows.

The Role of Masking in KYC Processes

Traditional KYC procedures involve collecting documents like Aadhaar cards, visage cards, or passports to corroborate an existent's identity. During these processes, guests are needed to partake sensitive data, which can be vulnerable to unauthorized access.

How Masking Helps?

- Protects Personal Data:Masking ensures that sensitive details like identification figures or addresses are incompletely hidden while still allowing verification.

- Reduces threat:In Manual Handling In physical KYC processes, documents are frequently participated in person or through dispatch, adding the chance of abuse. Masked performances minimize this threat

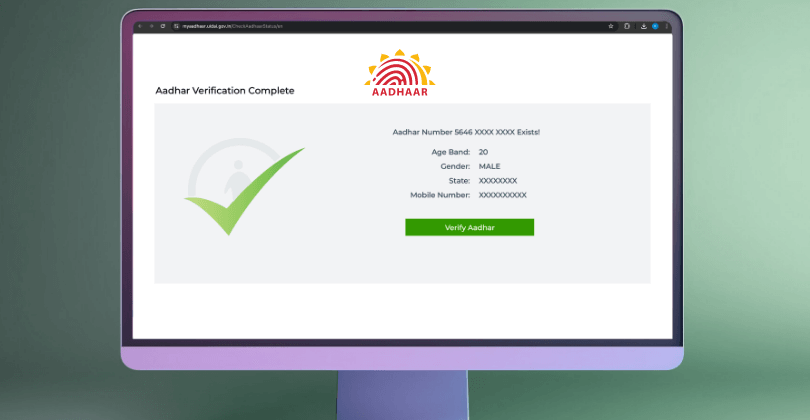

- Supports Secure Data Storage:Indeed when documents are stored temporarily during verification, masked data prevents unauthorized access by internal or external parties. For illustration, a bank may only display the last four integers of an Aadhaar number during client onboarding, icing that full details are n't exposed to workers or third parties.

- Enhancing e-KYC with Masking Technology:With the shift towards digital processes, e-KYC has revolutionized identity verification. By allowing customers to submit documents and verify identities online, businesses can onboard users faster and more efficiently.

Benefits of Masking in e-KYC:

- Secure Online Verification: Masking prevents sensitive data from being exposed during the transmission or processing of documents, reducing vulnerabilities in digital workflows.

- Fraud Prevention Masking:ways make it harder for fraudsters to misuse stolen or blurted data, strengthening trust in online verification platforms.

- Real- time Data Protection:Using dynamic masking technologies, businesses can reuse client data incontinently while icing that only authorized labor force have access to the complete information.

For case, a fintech platform conductinge-KYC for loan blessings can mask client data in real- time, enabling briskly verification without compromising security.

Improving Customer Onboarding with Masking Solutions

Customer onboarding is a multi-step process that involves collecting, verifying, and processing customer information before granting access to services. However, data privacy concerns and cumbersome workflows can slow down onboarding efforts.

How Masking Streamlines Onboarding?

A telecom provider, for example, using masked Aadhaar data for SIM activation can onboard new users quickly while minimizing security concerns.

How Masking Supports Compliance?

- Fulfills Regulatory Requirements:Masking solutions help businesses meet guidelines by obscuring sensitive data while retaining necessary information for verification.

- Maintains Audit Trails:Masked workflows can be tracked and monitored, providing transparency for regulatory audits and investigations.

- Reduces Liability:With masked data, businesses minimize exposure to legal and financial risks associated with data breaches or misuse.

In addition to regulatory compliance, masking solutions provide a security-first approach that guards against external cyber threats and internal mishandling.

Future Trends in Masking Solutions for KYC and Onboarding

As customer expectations rise and cyber threats evolve, masking solutions are continuously advancing.

Emerging Trends in Masking Solution

- AI-Powered Masking: Artificial intelligence is enhancing the accuracy of data detection and masking in real-time, even from low-quality images or incomplete datasets.

- Blockchain Integration: Some platforms are exploring blockchain-based masking solutions to create immutable audit logs and enhance trust.

- Privacy-by-Design Frameworks:Organizations are integrating masking techniques into their system architecture from the ground up, rather than as an afterthought.

- Cross-Industry Applications: Masking solutions are expanding beyond banking and insurance, into healthcare, retail, and logistics, adapting to diverse customer needs.

These innovations promise to make KYC, e-KYC, and customer onboarding more secure, seamless, and compliant than ever before.

Conclusion

Masking Results are now essential tools for companies handling KYC,e-KYC, and client onboarding procedures in a time when identity theft and data breaches are frequent circumstances. Masking technologies are revolutionizing how businesses handle identity verification by securing nonpublic data, guaranteeing legal compliance, and boosting consumer confidence.

Businesses can produce safer, more effective workflows and meet compliance norms by enforcing advanced masking results. Investing in strong masking ways is essential to creating a safe and dependable client experience as digital metamorphosis picks up speed.

Companies that put sequestration first and use slice- edge masking technologies are better equipped to handle legal issues, stop fraud, and give excellent onboarding services while guarding customer information.