How Financial Sectors Depend on Aadhaar Masking Solutions

Aadhaar-based financial solutions are a growing trend in the world of online security. These solutions allow financial institutions to mask their identities and operations by using Aadhaar numbers as ID proofs.

This protects the institution from various threats, such as credit card fraud. The technology behind these solutions is also being used to verify the identities of customers and employees. This helps to improve customer experience and safety and reduces the potential for identity theft. As we move closer to the 2020 elections, it becomes more and more important for candidates to be able to hide their true identities. This is especially important in the financial sector, where individuals are often required to provide sensitive information such as their income or assets. One way that candidates can protect their identity is by using aadhaar masking solutions.

Aadhaar is a unique identification system that is used by the Indian government and many private businesses. As the world moves towards a more connected society, businesses and citizens alike are increasingly reliant on digital services and technologies. One such service is the aadhaar card, which is a unique identity card issued to Indian residents. Due to the fact that the aadhaar is a highly personal information resource, businesses and citizens have relied on various methods to protect it from unauthorized access. One such method is to use financial sectors that rely on aadhaar masking solutions.

Understand the role of Masked Aadhaar in data privacy.

Data protection has become an increasingly important issue in recent years. With the rise of internet-based services and the increasing use of digital platforms, individuals have come to rely on these technologies to carry out their everyday lives. However, this reliance also means that individuals are increasingly subject to surveillance and tracking by companies and governments. One way in which companies and governments can track individuals is through the use of their Aadhaar numbers.

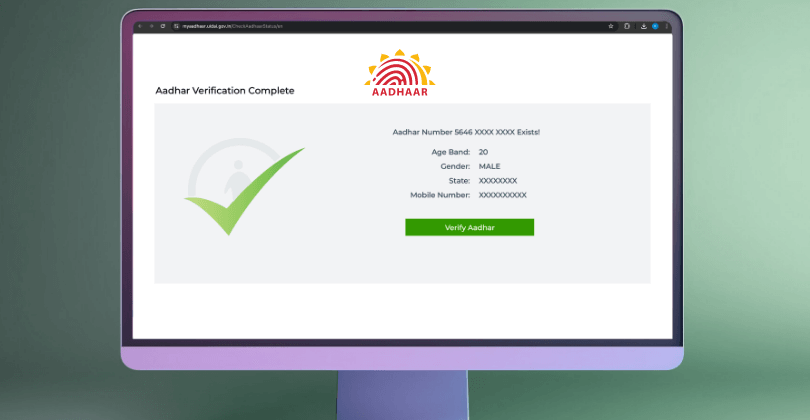

In a bid to enhance the safety and security of Aadhaar, UIDAI has launched a feature called 'Masked Aadhaar.' It is quite similar to a regular Aadhaar, with the difference that the Aadhaar number is partially covered.

Over 89% of India's total population has been issued Aadhaar as of the period of time 2018, consistent with varied news reports. The aadhaar card remains one of the foremost necessary document proofs because it holds each biometric and demographic details of the cardholder. The Unique Identification Authority of India (UIDAI) has repeatedly provided security for the Aadhaar database. Adding another layer of protection and strengthening the system, the UIDAI has introduced a new feature called ‘Masked Aadhaar’.

Who is Misuse the Aadhaar Card Number in Financial Institutions.

Here are five tips on how to do so:

- Use the card number to open new accounts or make payments.

- Strong data security:We must encrypt, manage access, and audit trails to keep Aadhaar data safe. These steps, if done right, authorize only certain staff to use sensitive information. A clear user access log records this. The appropriate authorities check and control this log..

- Use the card number to withdraw money from ATMs.

- Use the card number to get low-cost loans.

- Use the card number to get premium services offered by financial institutions.

There is a growing concern that the Aadhaar card number is being misused in financial institutions. The Reserve Bank of India (RBI) has issued a circular to all banks warning them against the misuse of Aadhaar cards. This is because the Aadhaar card number is linked to various personal details, including bank account numbers and individual identification numbers (IDs). There have been reports of people using their Aadhaar card numbers to open new bank accounts and obtain loans.