Aadhaar Masking Solution Allows BFSI Companies to Automate Classification and Extraction.

According to government guidelines, you must present an Aadhaar card in several cases, such as opening a bank account, insurance, fixed deposit, KYC video, and onboarding process.

The KYC documents submitted at the time of verification are kept as scanned copies. Banking and finance companies will have a large amount of customer-proof images in their database and in traditional systems that will not be separated or classified. In addition, the existing KYC process includes various phases of human intervention, including collecting and submitting relevant documents in the branches, scanning and uploading hard copies to the business process management system, and manually checking the image quality.

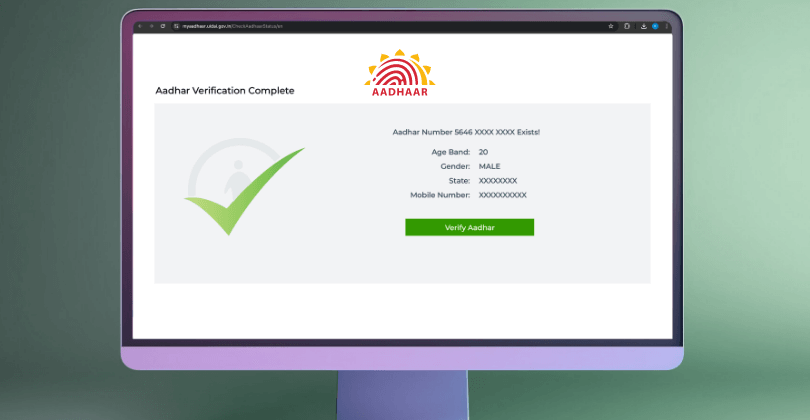

Extracting specific data from an image is an expensive and time-consuming process. Therefore, in order to accelerate customer experience and employee productivity, it is crucial to classify and segregate KYC documents. Advanced technologies like RPA and AI can accurately recognize 12-digit Aadhaar card numbers from images and videos. The regulatory authority also allows the use of AI and automation technology for such tasks in the KYC guidelines required by the RBI.

The Aadhaar masking solution puts an end to time-eating and mundane challenges with the aid of introducing an Aadhaar card masking. It provides the customer with an easy solution of masking Aadhaar data by default within a few seconds.

With Aadhaar card masking, BFSI companies can now automate the Aadhaar card classification, extraction, and masking of the first eight digits of an Aadhaar card in minimal time. This automated process will:

- Improving customer experience.

- Profitability and time savings.

- Preventing misuse of customer data.

- Keeping data confidential.

- Allowing staff to visually inspect and manually correct defective images.

The Aadhaar Masking Solution can mask 100,000+ documents in a short time while assuring compliance. This solution can also be customized to mask the name, date of birth, full Aadhaar number, QR code, and any other information on the Aadhaar card. Regardless of industries, the Aadhaar masking solution's personalized Aadhaar masking enables its customers to upload their Aadhaar details directly to your web and view the output folder for masked images and output log files. The aadhaar masking solution leverages AI and intelligent document processing capabilities such as OCR and NLP to generate high-quality, memory-efficient images and customize them to the client's styling and masking needs.

Considering the manual intervention and time-consuming steps involved in the KYC process, the value of the Aadhaar card masking solution for Banking, Financial Services, and Insurance (BFSI) companies is evident. The aadhaar masking solution store accelerates the robotic process automation initiative by providing ready action connectors and plug-and-play to automate complex business processes into simplified norms in a cost-effective and timely manner.